child tax credit dates december 2020

For 2022 that amount reverted to 2000 per child dependent 16 and younger. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

Parents Guide To The Child Tax Credit Nextadvisor With Time

By making the Child Tax Credit fully refundable low- income households will be.

. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The CRA makes Canada child benefit CCB payments on the following dates. Employers - Social Security Medicare and withheld income tax.

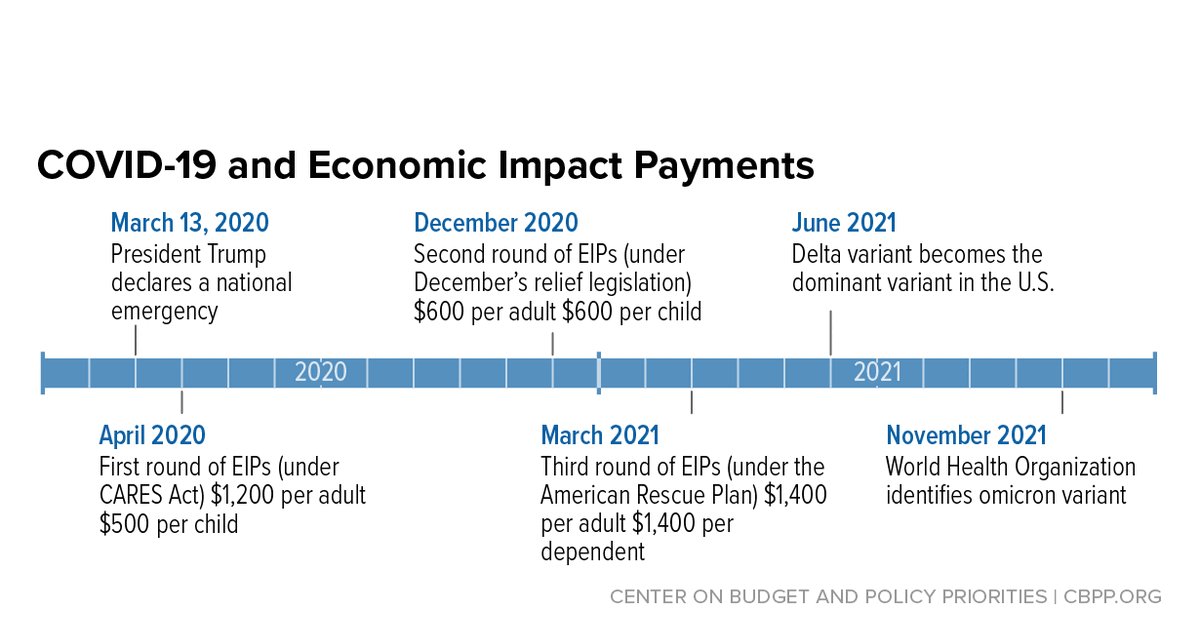

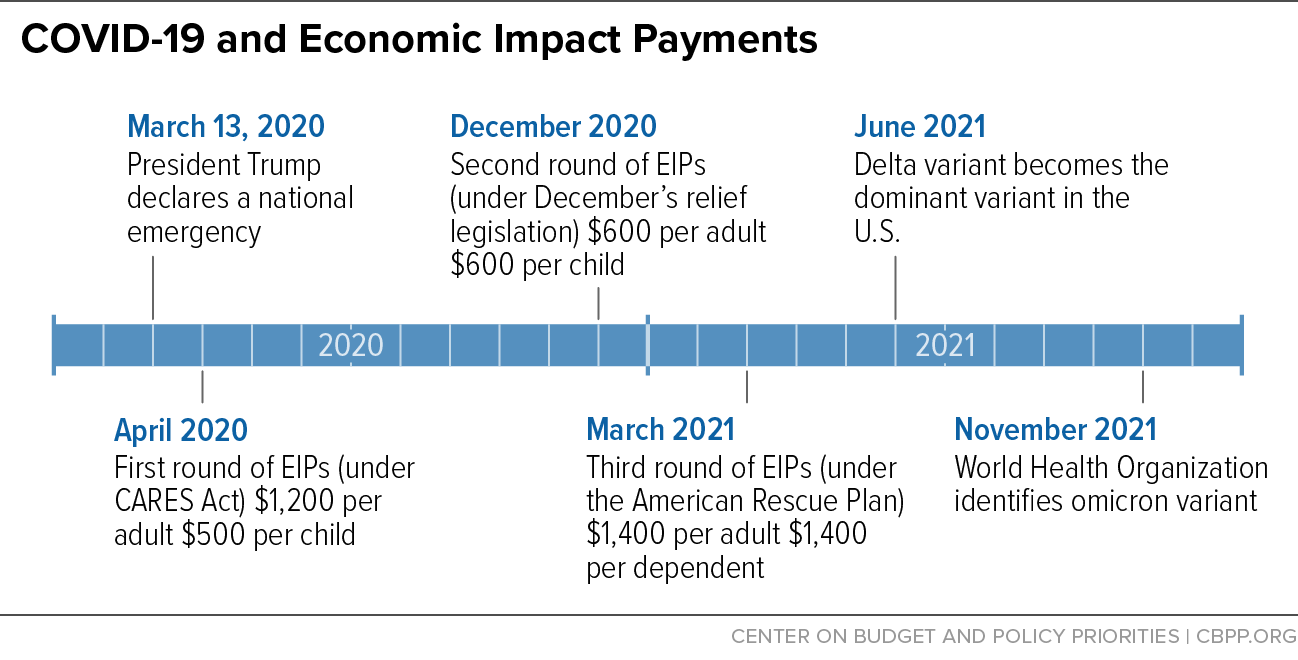

This is the final installment date for 2019 estimated tax. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. 28 December - England and Scotland only.

The maximum amount of the credit for. 1200 in April 2020. The advance payments accounted for 50 of the credit you were due with the remainder and any adjustments to be claimed via your 2021 tax.

CCB Payment Dates for 2022. 821 New Jersey Tax Calendar 1121 123121 2 Tobacco and Vapor Products Tax TPT-10 Monthly return January 22 January 22 Motor Fuel Tax DMF-10 Distributors monthly return RMF-10 Combined Motor Fuel Tax return ultimate vendors-blocked pumps aviation fuel dealers LPG dealers and consumers SMF-10 Suppliers. Payment Dates for Weekly Payers.

Instead you will receive one lump sum payment with your July payment. Chronological Listing of Filing Deadlines. 1400 in March 2021.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. However the deadline to apply for the child. The maximum amount of the credit for.

If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years the credit amount was 1000. That payment date is Dec. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

Starting on July 15th through December families can get monthly Child Tax Credit payments of 250 per child between 6-17 or 300 per child under 6. All payment dates. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Wait 10 working days from the payment date to contact us. January 1 2020 - December 31 2020. Claim the full Child Tax Credit on the 2021 tax return.

However you do not have to make this payment if you file your 2019 return Form 1040 and pay any tax due by January 31 2020. If the monthly deposit rule applies deposit the tax for payments in December. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per.

1400 in March 2021. Discover Helpful Information And Resources On Taxes From AARP. Go to My Account to see your next payment.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The IRS bases your childs eligibility on their age on Dec. The maximum amount of the child tax credit per qualifying child.

Alphabetical Summary of Due Dates by Tax Type. It is in addition to the credit for child and dependent care expenses on Schedule 3 Form 1040 line 2 and the earned income credit on Form 1040 or 1040-SR line 27. Here are the official dates.

We dont make judgments or prescribe specific policies. 15 opt out by Aug. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. You will not receive a monthly payment if your total benefit amount for the year is less than 240. 3 January - England and Northern Ireland.

Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment. 600 in December 2020January 2021. For children under 6 the amount jumped to 3600.

October 5 2022 Havent received your payment. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. The maximum amount of the credit for.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. The credit amount was increased for 2021.

It is a partially refundable tax credit if you had earned income of at least 2500. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. 1200 in April 2020.

Here are some numbers to know before claiming the child tax credit or the credit for other dependents. COVID-19 Stimulus Checks for Individuals. If you dont receive your CCB payment on the expected.

The payments will be made either by direct deposit or by paper. The maximum child tax credit amount will decrease in 2022. The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax.

The credit was made fully refundable. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card.

The maximum child tax credit amount will decrease in 2022.

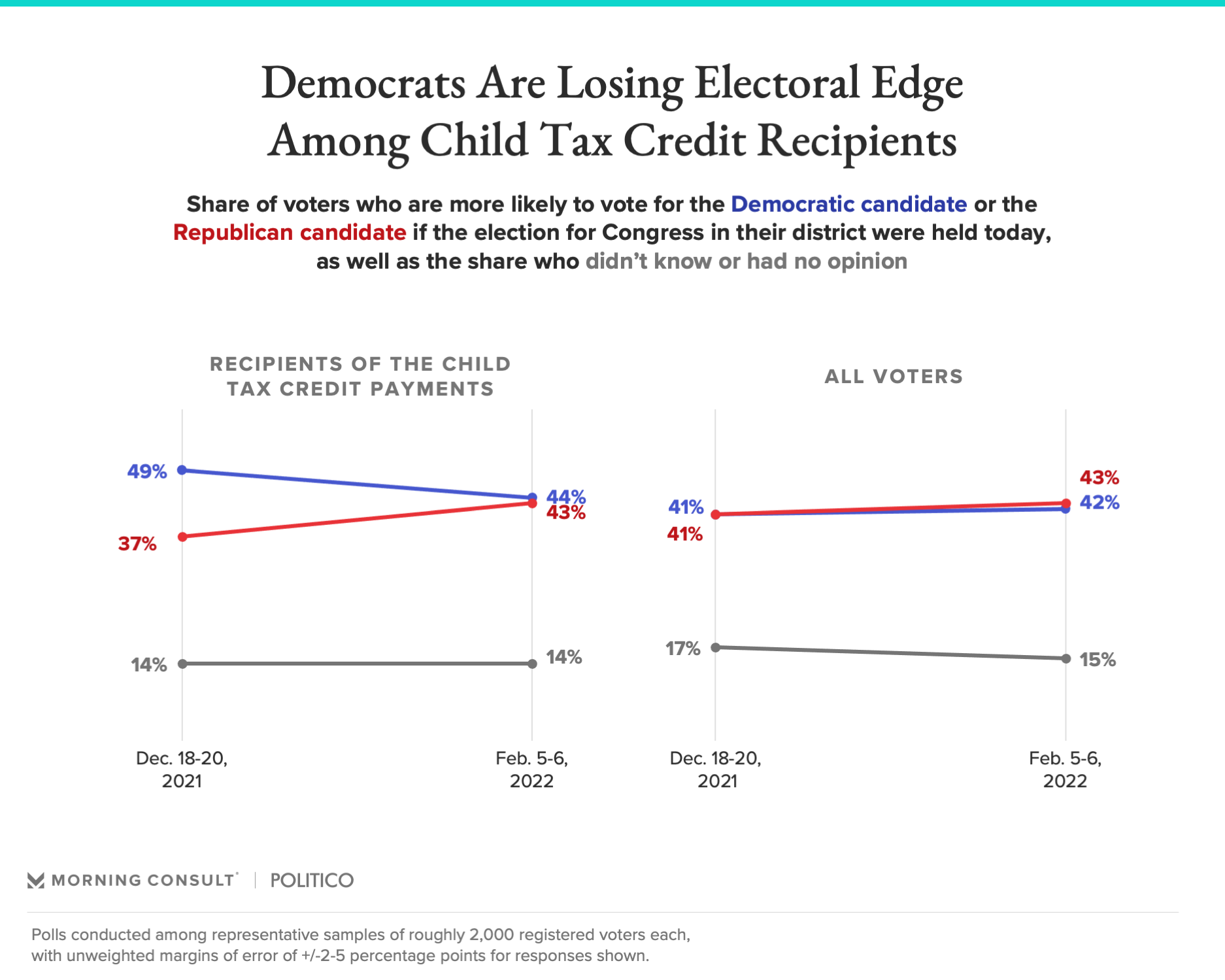

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

2021 Child Tax Credit Advanced Payment Option Tas

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

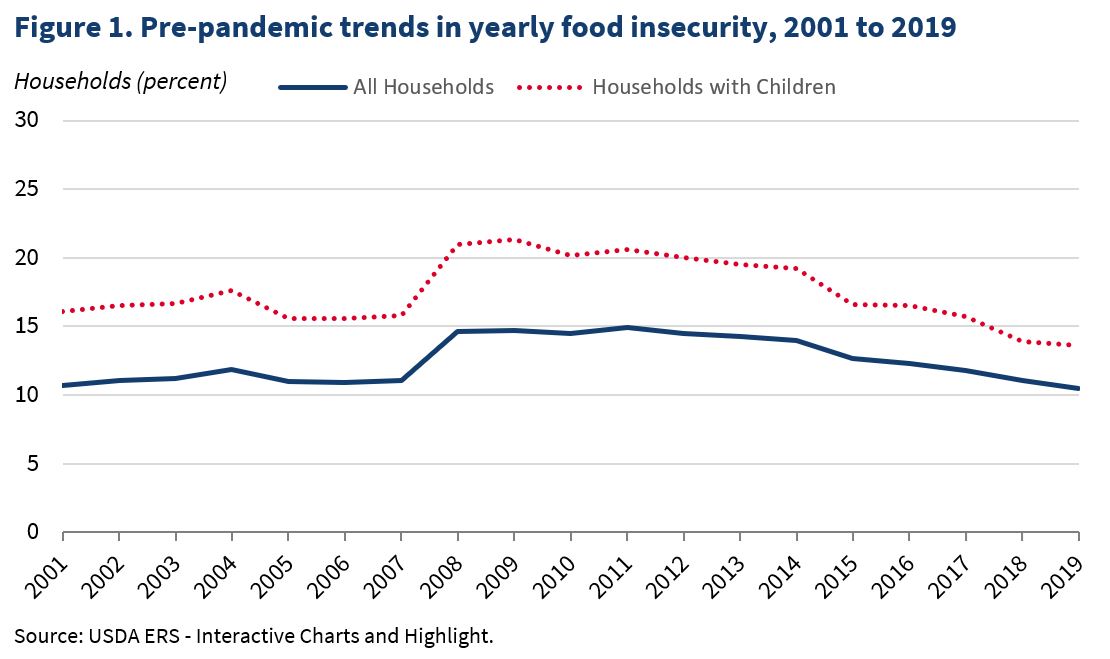

Federal Income Support Helps Boost Food Security Rates The White House

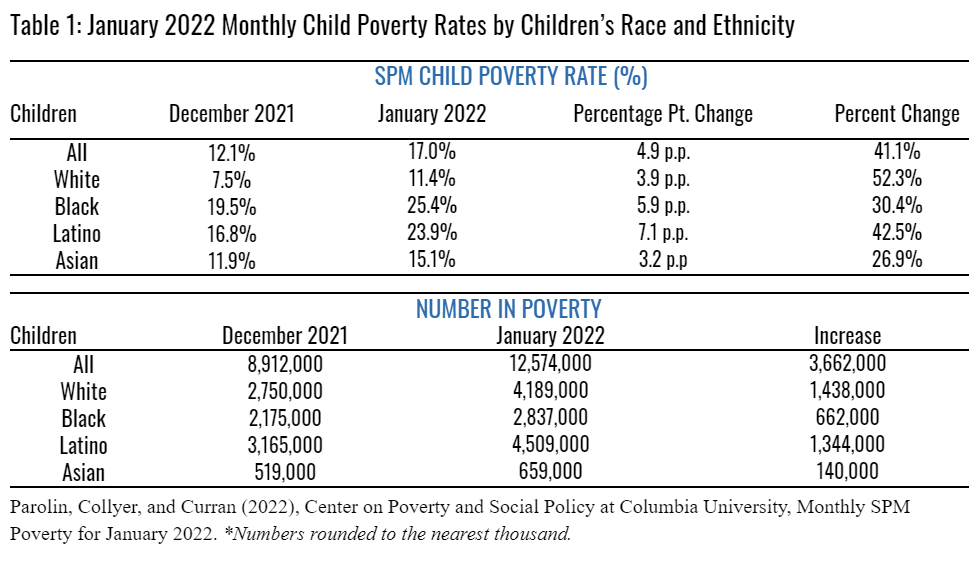

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

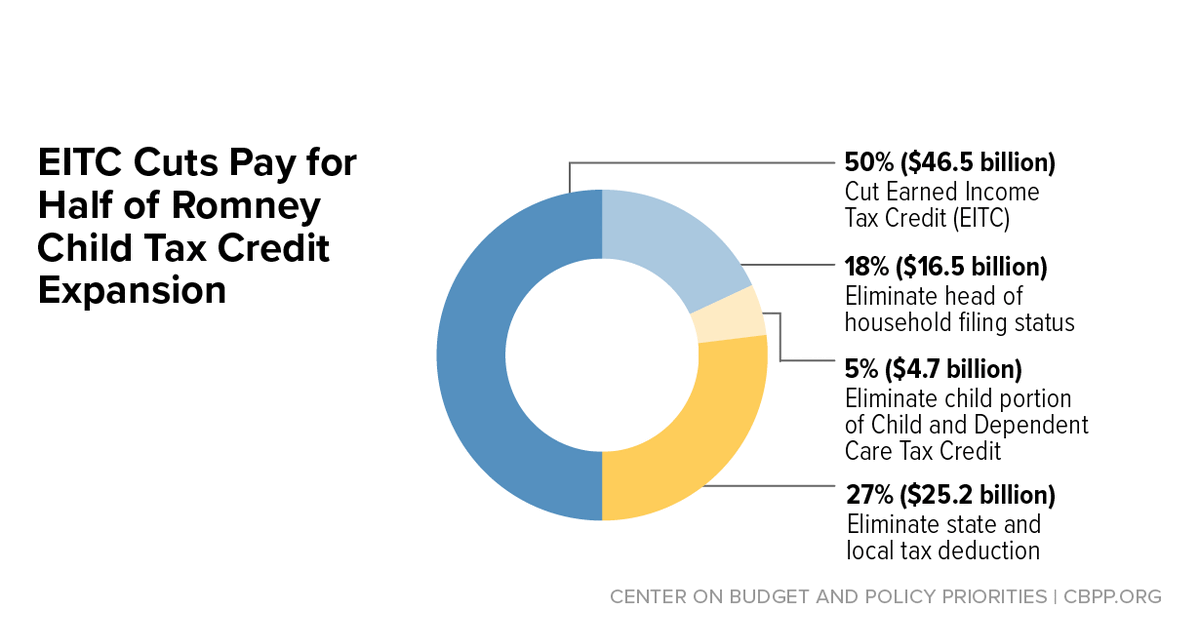

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Employee Retention Tax Credit Office Of Economic And Workforce Development

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities