do closed end funds have liquidity risk

Bond ETFs use of liquidity screens mean they tend to hold less liquidity-risky assets. The value of a CEF can decrease due to movements in the overall financial markets.

Closed End Fund Definition Examples How It Works

Costs the expense ratios are competitive with most open end mutual funds but still.

. Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the shareholders Faust says. Active bond funds more likely to target illiquid investments. Those shares are first issued through an IPO and then trade on an exchange just like stocks or ETFs.

Among the advantages CEFs - unlike open-end mutual funds - trade at a discount or premium to net asset value. The industry offers more than 580 CEFs with assets exceeding 290 billion according to the. So for instance a CEF that is valued at 10 may.

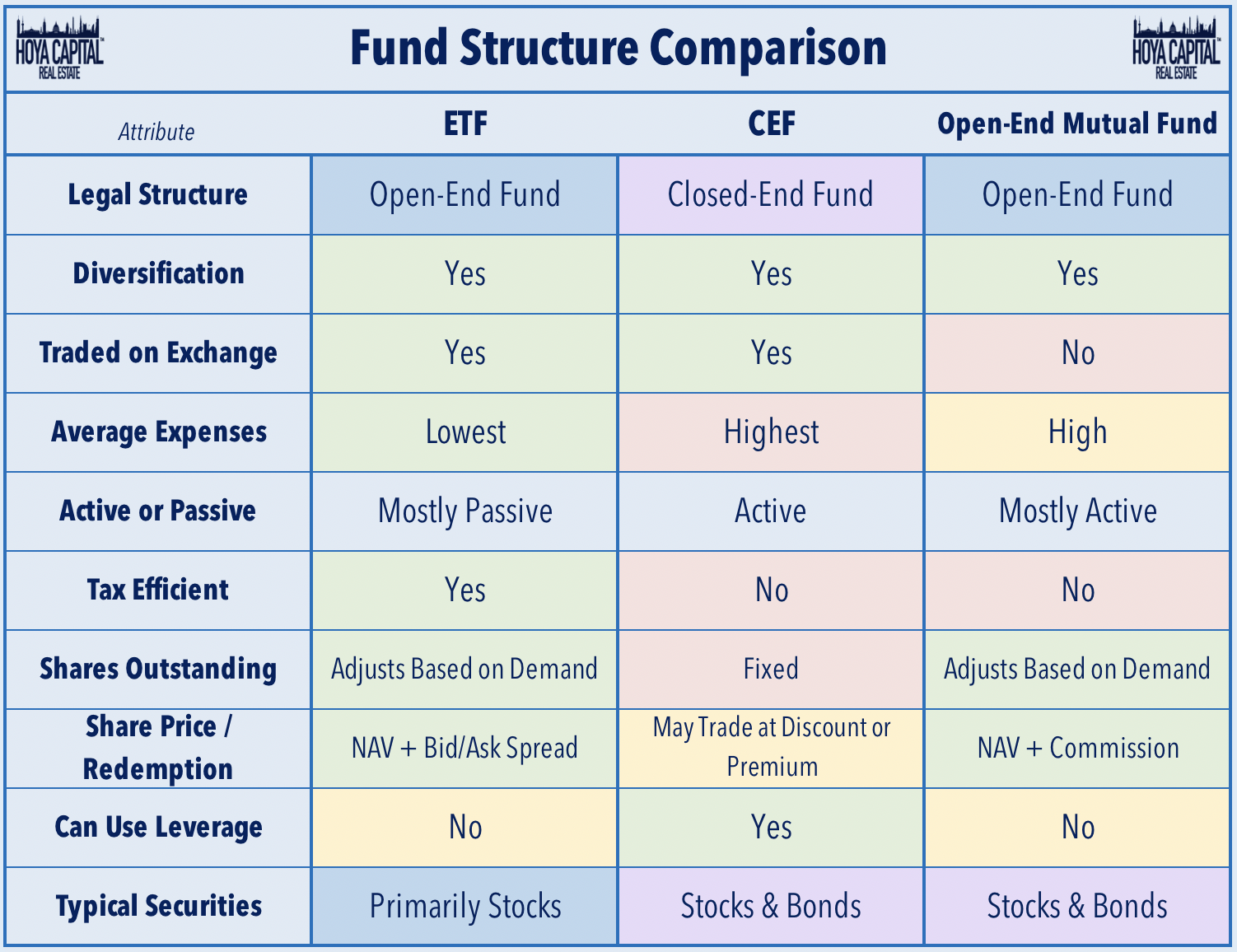

A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end funds usually mutual funds and unit investments trusts UITs. Closed-end funds may trade at a premium to NAV but often trade at a discount. With a closed-end fund the number of shares is fixed and shares are not redeemable from the fund.

Liquidity Risk Although CEFs are listed and traded on an exchange the degree of liquidity or ability to. Unlike open-end funds closed-end funds do not need to maintain liquidity to meet daily redemptions. NAV is important because it reflects the value of net assets held in a portfolio.

Just like open-ended funds closed-end funds are subject to market movements and volatility. Funds or funds4 or closed-end upon which several of the Acts other provisions depend turns on whether the investment companys shareholders have the right to redeem their shares on demand. This can result in.

Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the underlying portfolio. Their yields range from 632 on average for bond CEFs to. Perhaps they should be.

However closed-end funds have several important differences compared to the mutual. The closing price and net asset value NAV of a funds shares will fluctuate with market conditions. The closed-end structure Mark Northway explains provides the manager with the benefit of permanent or long-term committed capital while.

This makes ETFs much less likely to have. When the Investment Company Act was enacted it was understood that redeemability meant that an open-end fund had to have a liquid portfolio. Any day when theres a 1 move in a CEF can be thought of as a day when there is a supply and demand imbalance outside of ex-dividend days and large moves in.

Here are ten reasons to consider closed-end funds. Rule 22e-4 also requires principal underwriters and depositors of unit investment trusts. Look for Discounts and Premiums.

Closed-end funds issue a fixed number of shares through an initial public offering and typically do. Unlike open-end funds managers are not allowed to create new shares to meet demand from investors. CEFs are exposed to much of the same risk as other exchange traded products including liquidity risk on the secondary market credit risk concentration.

It remains true that ETFs have greater liquidity than mutual funds. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market. Leverage magnifies returns both positively and negatively.

10 Best Closed-End Funds. This CEF has a leverage ratio of 50 computed as capital from preferred shares divided by net asset value. On a percentage basis the fund sells at a discount of 10 2 divided by 20.

Its assets are actively managed by the funds portfolio managers and may be invested in equities bonds and other securities. 1 day agoThat in a nutshell explains the problem with the structure of closed-end funds like the 32 billion Nuveen CA Quality Muni Income ticker. In this case the closed-end fund sells at a discount of 2 per share.

Closed-end funds also have an NAV that is calculated daily. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. Closed-End Funds and Liquidity Open-ended funds have no limit on the number of shares they can issue and capital flows into and out of the funds freely as new shares are issued and repurchased.

Like a mutual fund a closed-end fund is a pooled. See locating the leverage status using the closed-end fund screener for more information. If the market price is above NAV say 21 in this case then the closed-end fund sells at a premium of 5.

New SEC Rule Requires Open-End Funds to Have Formal Liquidity Risk Management Programs. Investing in the bond market is subject to risks including market interest rate issuer credit inflation risk and liquidity risk. CEF shares are bought and sold at market price determined by.

Yet closed-end funds CEFs are not nearly as popular as open-end mutual funds. Factors That Influence ETF Liquidity. Thus they have more flexibility to invest in less liquid securities.

The measure of liquidity of an ETF depends on a combination of primary and secondary. Lets assume that the market price is 18 per share and that NAV is 20. Just like open-ended funds closed-end funds are subject to market movements and volatility.

This is a significant risk for closed end bond funds as a default by one or more of the CEFs underlying bond holdings can have a significant impact on the CEFs NAV market price and ability to make distributions to shareholders. 5 from preferred shares 10 in net asset value 50. Exchange-traded funds ETFs are generally also structured as open-end funds but can be structured as.

The value of most bonds and bond strategies is impacted by. Closed-end funds CEFs can be one solution with yields averaging 673. Closed-end funds have more regulatory flexibility than open-end funds to.

On the other hand closed end funds have a fixed number of shares. LiquidityLow Volume higher liquidity risk exists for funds with low volumes.

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

Tourshabana What Are Closed End Vs Open End Mutual Funds Compare 4 Key Differences In Investing

What Are Mutual Funds 365 Financial Analyst

What Is The Difference Between Closed And Open Ended Funds Quora

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

Investing In Closed End Funds Nuveen

Closed End Fund Fs Investments

What Is The Difference Between Closed And Open Ended Funds Quora

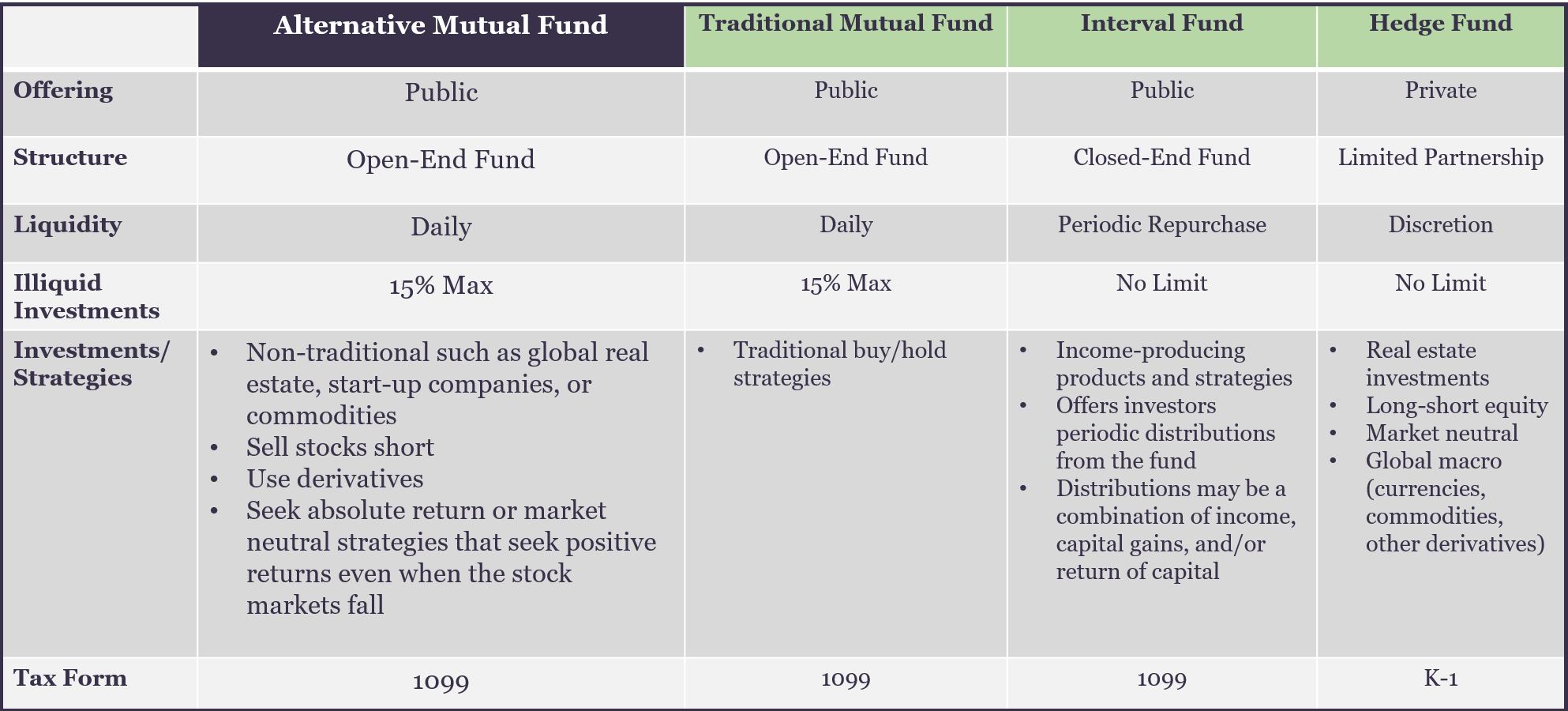

Alternative Mutual Fund Liquidity Spectrum Investment Comparison

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered